SEMA News—March 2020

BUSINESS

“SEMA Retail Landscape Report” Now Available for Download

Unique Market Study Sheds Light on the Business of Selling to Consumers

Despite dynamic changes in the retail environment, automotive specialty retailers remain optimistic about business growth. The first-ever “SEMA Retail Landscape Report” delves into their reasons for optimism, along with the challenges and tactical opportunities they’re finding in an increasingly digital marketplace. |

It’s no secret that the retail environment has changed significantly over the past decade. Automotive specialty-equipment retailers in particular are dealing with new pressure points on a number of fronts. But what are the emerging trends that have industry retailers most concerned? And, more importantly, what tools and best practices are they utilizing to adapt? Those questions are at the forefront of a new SEMA market research report.

Titled “SEMA Retail Landscape Report: The Business of Selling to Consumers,” the 104-page study is available for free download at www.sema.org/market-research. The report includes major sections addressing the current state of specialty retail, along with close looks at the specific challenges and opportunities confronting retailers in the automotive aftermarket.

In addition, the report’s “Detailed Findings” section offers a deep dive into statistics touching on a wide variety of hot-button topics. Those include industry trends in sales and database management, marketing, changing customer buying habits and other retail-related issues. The report also contains a wealth of insights into marketing, advertising and communications tools, including social media; online sales and marketing practices; inventory management and shipping issues; and retail systems and processes.

| Annual Sales Growth |

Throughout the past decade, small businesses have continued to dominate the retail landscape, with general auto parts retail seeing steady growth. |

“We know we have a huge sector of our SEMA membership on the retail side of the business,” said Gavin Knapp, SEMA director of market research. “A lot of them are very small companies. Our market research typically helps them understand the broader market or what industry customers are doing, so this report is a departure for us and somewhat different in terms of results. It focuses on the business side of retailing and sets out to help those companies from that standpoint.”

SEMA commissioned an independent research provider, W5 Inc., to execute the project. The study included in-depth telephone interviews and an online survey of people who own or manage specialty automotive retail businesses. Respondents represented businesses serving different sectors of the industry, such as truck accessories, off-road, tuning and speed shops. The report is further supplemented with relevant data from SEMA and third-party sources.

The research shows that small, single-location brick-and-mortar stores remain the backbone of the specialty auto parts retail space. Moreover, most shops get by with a small staff of employees. Sales channels break down as 69% through brick and mortar, 54% via a company website, 48% through phone/catalog sales and 39% through an online marketplace. Outlets with one to four employees represent 46% of the industry, while those with five to nine employees account for 21%.

| Retailers Perceptions of Customers |

Aftermarket retailers perceive erosion in customer loyalty as a consequence of digital trends. Not only have consumers increased their online shopping but also they come armed with price comparisons from a variety of online sellers when they do enter a brick-and-mortar environment. |

“There are a couple of overarching results in the research that I think are important foundationally,” Knapp said. “One is that a lot of the businesses are run by industry enthusiasts. A lot of times, somebody who is an enthusiast will morph into retailing more as a way to stay in the hobby and lifestyle than to actually be a business person. That’s great, but it also sometimes leaves them without some of the business foundations that a lot of those companies are now trying to catch up on.”

Matt Kennedy, SEMA research manager and the project’s lead, said that the researchers also found that a lot of the issues and challenges those companies are facing are really small-business issues in general.

“That kind of gets compounded when you see people who are trying to run a small business and all that entails who are not by inclination or by education business people,” Kennedy said. “They’ve learned by doing and are often wearing too many hats to find an easy way to pick up the extra training and knowledge that would make some of this stuff easier.”

Far from presenting a bleak picture for industry retailers, the study found that many are embracing the rapidly evolving marketplace and finding new opportunities through a number of best practices.

| How the Industry Has Changed |

Industry retailers now view large online competitors as their greatest concern, with increasing wholesale parts costs also seen as a top challenge. The growing diversity and complexities of parts are also adding pressures on retailers. |

Chief Retailer Concerns

Of the major difficulties confronting today’s aftermarket retailers, the SEMA research identified three overlapping concerns: increased competition from the online retail space, eroding consumer loyalty, and the rising costs and complexities of products.

“Online sales are growing and creating all manner of challenges,” Kennedy explained. “That’s as true for our industry as it is elsewhere in retail, if not more so. In all our research, we keep seeing that we’re even ahead of the curve when you look at overall retail versus specialty auto. A lot of businesses that we talked to are definitely feeling the pressure of competition from big online companies and even from smaller competitors who are also in the digital space. It can feel tough for smaller enthusiast retailers to adapt. Online is now a much bigger thing than it was 20 years ago.”

The broader range of competition naturally leads to erosion in customer loyalty, especially for brick-and-mortar outlets. The bottom line, Kennedy said, is that consumers now have more options than ever in terms of learning about products, where to buy them, and even how to install those products themselves.

“While it’s not necessarily a brand-new paradigm, this idea of suddenly having a new source of competition or consumers having other ways to get the stuff they want is definitely something retailers are concerned about,” he said. “Consumers can now go into a store and already have an idea not just of a part they want but also what price they can expect to pay for it elsewhere.”

Knapp noted that, while today’s consumers are indeed more knowledgeable than ever before, the trend is based mainly on self education.

“Everybody is online now,” Knapp said. “Everybody researches before they buy. It’s the way of the world. They know all the brands that are available, the specs, fitments and competitive pricing.”

However, he hastened to add, there are limits to customers’ expertise, and that plays a large role in the opportunities roadmap that the “SEMA Retail Landscape Report” eventually lays out.

Meanwhile, escalating wholesale parts costs have been a third trouble spot for retailers.

| Opportunities for Success |

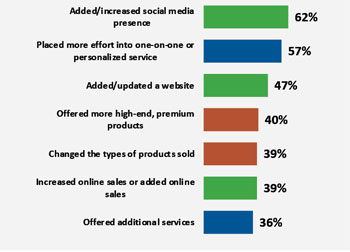

In adjusting their sales and marketing tactics to the new realities, specialty-equipment retailers are placing a greater emphasis on social-media presence and personalized customer service. They are also offering a wider range of high-end products. |

“Obviously, costs are also going up,” Kennedy said. “Products are becoming more expensive by virtue of inflation and also just because they’re getting more advanced. Put that against how consumers are more aware of competitive pricing options, and it can feel like a retailer’s margins are getting a little squeezed.

“The reality of it to some extent is that the more things change, the more they stay the same. As vehicles become more advanced, as technology changes, and as more products and more models become available out there, it’s a challenge to keep track of it all. It’s a challenge to make sure you have people who are up-to-date on what they need to know and the tools needed to install those products. You have to be as informed about the options that are out there—if not more so—than the consumers who come into your store.”

Knapp underscored that point.

“More brands, more SKUs—how do you keep up with all of it?” he asked. “How do you know what fits what? And with consumers being more informed as well, retailers have to make sure that they’re fully informed because if they’re not keeping up, customers will know. And they’ll go to a competitor because now there’s going to be a lack of trust.”

Moreover, today’s marketplace often appears toughest on mom-and-pop operations.

“Unfortunately, when we’re talking about small businesses, we’re back to one guy tending to wear a lot of hats,” Knapp observed.

| How Retailers Have Adapted |

Despite considerable challenges, aftermarket retailers have identified new avenues of opportunity offered by the web, including social media. The Internet has also given retailers access to new processes and systems to find new products and boost sales. |

Identifying Opportunities

The good news is that the report nevertheless finds small retailers adapting and even thriving. Despite negative media hype, brick-and-mortar sales have held steady and even grown over the past several years. In fact, 53% of retailers, in general, said they saw sales increases over the past year, with an even more robust 70% anticipating growth in the year ahead. So what accounts for the upbeat picture?

“What we basically did for the opportunity side of the report was ask businesses how they’ve been adapting to their challenges and how they’re finding solutions,” Kennedy said. “We again ended up grouping their answers into three broader themes, because they’re all integrated in some way.”

One successful path for retailers has been to embrace an omni-channel strategy for both marketing and sales. That means maintaining a presence where your customers are—not just online but also wherever they’re researching and looking for ideas. How a retailer executes an omni-channel strategy will vary greatly depending upon its location, size of store and staff, not to mention its particular branding or product niche. Some examples might be web forums and social-media sites, including YouTube, Facebook, Instagram and Pinterest, as well as local car clubs, enthusiast events and other local gatherings.

“We’re not saying that you have to go throw a ton of money into all these different points,” Knapp explained. “It’s more about looking for the best ways you can actively engage your current and potential customers. It’s about being aware of where to find your customers, figuring out the most effective way to reach them and knowing that it’s not as simple as just having a store. The days of placing an ad in the Yellow Pages and waiting for people to roll in are long gone.”

And while many brick-and-mortar outlets have sought to expand their customer reach through online sales, Knapp cautioned against seeing that tactic as some sort of panacea. Yes, a virtual storefront can be a winning strategy, but it must be carefully thought out. It won’t necessarily fit every retail business model and will require much more than a flashy new e-commerce site.

| Overall Retailers Are Optimistic |

Amid marketplace pressures, retailers still maintain a healthy optimism regarding sales trends. The majority surveyed for the report (53%) have seen sales gains in the past year, and an even greater number (70%) are anticipating growth in the year to come. Amid marketplace pressures, retailers still maintain a healthy optimism regarding sales trends. The majority surveyed for the report (53%) have seen sales gains in the past year, and an even greater number (70%) are anticipating growth in the year to come. |

“It’s going to give you minimal push if you’re not driving traffic to it,” Knapp asserted. “You have to be involved in events around you, social media and all of those touch points where your customers are getting information—and they’re getting it all over the place.”

In addition to omni-channels, the “SEMA Retail Landscape Report” identifies a focus on “customer experience” as a key component for success.

“It’s not always possible or easy to compete purely on price,” Kennedy observed. “What a decent number of businesses do in response to that is work on competing on service, advice and expertise. If you can’t be the cheapest in town, you can be somebody who gives customers more than one reason to come to your store. It’s about getting your customers to say, ‘I want to go here because they treat me right, they talk about what I need, they offer me the best solutions, or they host events on-site.’”

All told, 57% of retailers surveyed said that they’ve adapted to the changing retail climate by putting more effort into one-on-one or personalized service. That includes engaging with consumers and providing personal advice and expertise through customer service and support via the phone (83%), one-on-one conversations (78%), off-site events (55%), online chats (30%) and video tutorials (17%).

| Marketing and Advertising Channels |

When it comes to marketing and advertising, retailers have made the transition to digital. Of the channels most often utilized, social media tops the list, with the majority of retailers surveyed also saying it has proven the most successful. |

While consumers are indeed more highly informed than ever, they’re also bombarded with information on the internet, notably from social media and enthusiast forums. Helping customers cut through the clutter with experience and sound advice goes a long way toward establishing trust. Some retailers have even reported success offering demo days, learning events and in-store gatherings to share ideas, have some fun and create a community.

The third area of opportunity identified by the research is improved operational efficiencies, which can apply to both people and systems.

“Right now, small companies are universally having problems finding, training and keeping the right people, so there’s an opportunity for those businesses that can do it well,” Knapp said. “Businesses that can step aside from sales for a bit and build in some training appear more able to thrive.”

Businesses should take a long-term approach to staffing, looking for new ways to find and recruit people and establish pipelines with trusted resources. Connect with community organizations, local high schools and junior colleges.

“Knowing people, building relationships and networking is more important now than ever before,” Knapp noted.

Moreover, many retailers seem hindered by solutions they have cobbled together over the years in the area of systems and processes—digital systems for sales, accounting, ordering and the like that don’t “talk” to each other.

“If you can’t move information between your systems or you have to do it manually, that creates a lot of inefficiency,” Knapp pointed out. “It can be hard to invest the time and money needed to improve the situation, but then think of the time and money you’re losing.

“We’re not saying you need a big, fancy integrated system. The reality is that there are national and multinational retailers that are having the same struggles finding their own solutions. It’s more about taking time to think about where there are break points, where you have inefficiencies. How can you create something a little more integrated or seamless that lets you save a few minutes here and there? Those few minutes add up in the long run.”

Even as they adapt and embrace the growing pains, smaller aftermarket retailers can take additional comfort in another key SEMA market research finding.

“The type of retail that’s doing well now is specialty retail—retail that’s focused on a certain niche or a certain type of experience,” Knapp said. “The great thing is that’s exactly what our guys are doing. They don’t need to compete with Amazon or try to be Amazon. They just need to be who they are and make sure that their customers know it.”

| Get the Report! | |

| To download the “SEMA Retail Landscape Report,” along with other SEMA market research studies that can help your business, go to www.sema.org/market-research. All downloads are free. |

For Kennedy, that means “being authentic and telling your company’s brand story. In comparison, the big guys online may be great repositories of products at a good price, but they’re kind of faceless. Give yourself a face. Put that face out there. Tell your story. Make people relate to you, and you’ve got the edge.”